will capital gains tax increase in 2021 be retroactive

JD CPA PFS. At this point many ideas are being considered as.

Are You Ready To Talk Tax Join Us Live 3pm Az At The Tax Goddess Facebook Page For Our Live Q A Session With Shauna The Tax Goddes Tax Questions Cpa Business

Still another would make the change to capital gains tax retroactive with a start date of april 202112.

. Restaurants In Matthews Nc That Deliver. Top earners may pay up to 434 on long-term capital gains including the 38 Net Investment Income Tax. The 2022 Greenbook indicates that the proposed capital gains tax increase as part of the American.

The Wall Street Journal reports that President Bidens proposed capital-gains tax rate increase is assumed to have taken effect Apr. Transition tax etc all retroactive to. While a large increase in the tax is unlikely heres how you can help your clients prepare.

My guess is that since the democratic majority is so thin there is little chance any tax increase will be made retroactive to january 1 2021. The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38 Medicare surtax. President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering 82 increase.

Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of. As of 2021 the long-term capital gains tax is typically either 0 15 or 20 depending upon your tax bracket. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President. President Joe Bidens proposal to raise the capital-gains tax rate to 396 from 20 for those earning 1 million or more was first announced April 28 as part of the administrations American. The current estimate of that effective date ranges from October 15 2021 on the early.

Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at. This plan was made to be retroactive in order to make it harder for investors to prepare. If this were to happen it may not only seem unfair but it is also bad tax policy.

Another would raise the capital gains tax rate to 396 for taxpayers earning 1 million or more. Are Dental Implants Tax Deductible In. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Whats clear is that a capital gains tax hike is almost certainly on its way. Then there is timing. The large tax liability owed at filing is mostly the result of a surge in capital gains and other income from financial assets in 2021.

Restaurants In Erie County Lawsuit. Also notable that since it would be retroactive to April 28 2021 it could influence many folks who took gains during the latest crypto surge. President Joe Bidens American.

A Retroactive Tax Increase Biden wants to tax capital gains you made even before a bill passes. When the NIIT is added in this rate jumps to 434. One idea in play is a retroactive capital gains tax increase.

June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. On May 28th 2021 the United States Department of the Treasury published the Greenbook for the Biden Administration Budget Plan.

Long-term capital gains are normally taxed at 15 on the federal level although a big enough profit could push you into the higher 20 capital gains bracket. The bank said razor-thin majorities in the House and Senate would make a big increase difficult. This resulted in a 60 increase in the capital gains tax collected in 1986.

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. The Treasury Greenbook is a summary explanation of an Administrations Revenue Proposals for the upcoming fiscal year and beyond. Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan.

Capital Gains Tax Increase 2021 Retroactive. Opry Mills Breakfast Restaurants. June 16 2021 1108 am pdt.

Households owed more than 500 billion in taxes when they filed their returns this year an increase of. 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a one-time 25 percent wealth tax7 and imposing an annual 2 percent or 3 percent wealth tax8 One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238. In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy.

It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. Still another would make the change. Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

President Bidens American Families Plan proposes increasing the tax rate on long-term. May end up being taxed more heavily by the.

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

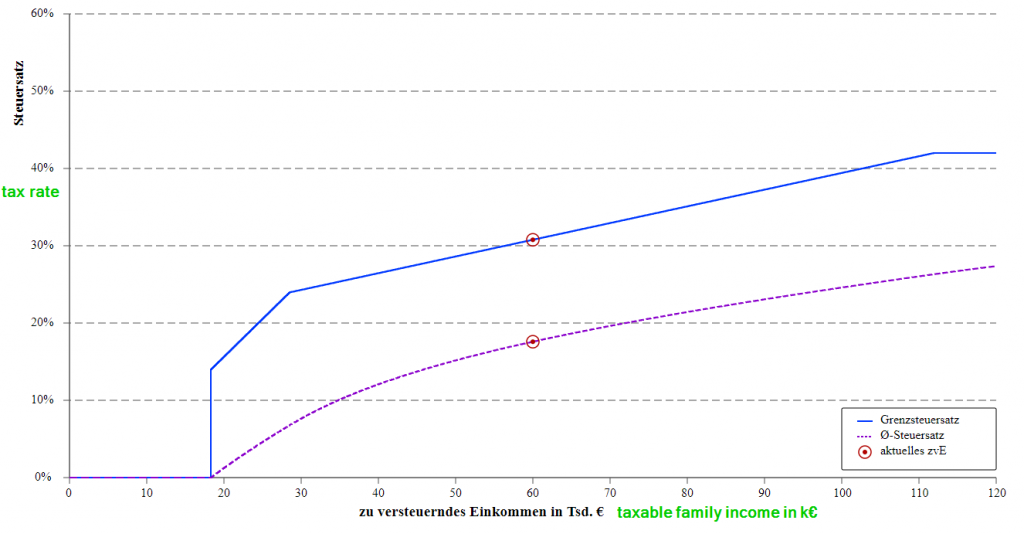

Faq German Tax System Steuerkanzlei Pfleger

How To Help Your Real Estate Investor Clients Structure Their Businesses Accounting Today In 2021 Real Estate Investor Real Estate Investors

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

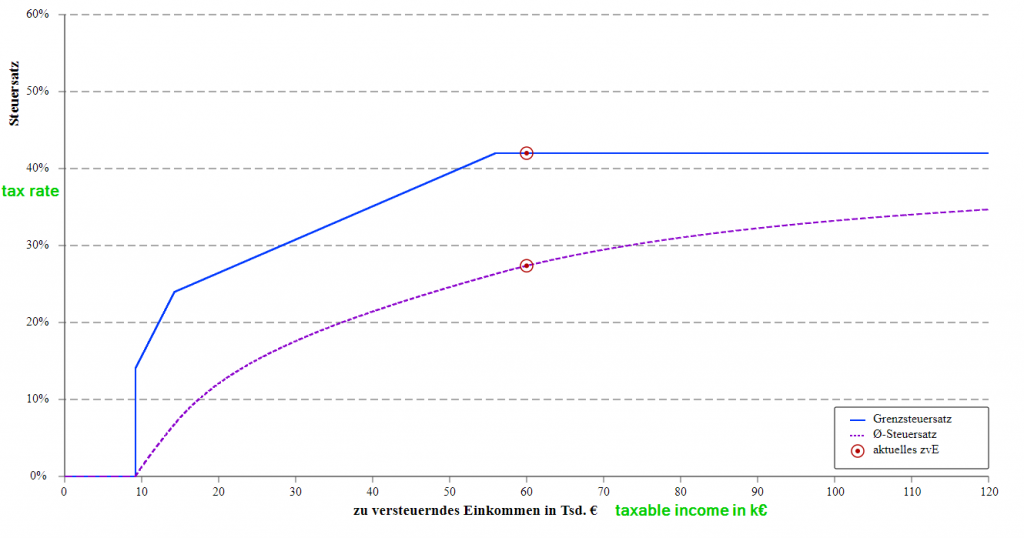

German Tax Laws Pushed Through Before End Of Current Parliamentary Term Verena Klosterkemper

Macroeconomic Effects Of The Anticipation And Implementation Of Tax Changes In Germany Evidence From A Narrative Account Christofzik 2022 Economica Wiley Online Library

Macroeconomic Effects Of The Anticipation And Implementation Of Tax Changes In Germany Evidence From A Narrative Account Christofzik 2022 Economica Wiley Online Library

Withholding Tax Relief Modernization Act

Macroeconomic Effects Of The Anticipation And Implementation Of Tax Changes In Germany Evidence From A Narrative Account Christofzik 2022 Economica Wiley Online Library

Faq German Tax System Steuerkanzlei Pfleger

Macroeconomic Effects Of The Anticipation And Implementation Of Tax Changes In Germany Evidence From A Narrative Account Christofzik 2022 Economica Wiley Online Library

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Germany Taxation Of Cross Border M A Kpmg Germany

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

German Check The Box Option For Partnerships Ebner Stolz

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Macroeconomic Effects Of The Anticipation And Implementation Of Tax Changes In Germany Evidence From A Narrative Account Christofzik 2022 Economica Wiley Online Library